Francesco Sangiorgi

Frankfurt School of Finance & ManagementAssociate Professor of Finance

Francesco Sangiorgi works primarily on the economics of information as applied to financial markets. His research questions span topics in asset pricing, market microstructure, information intermediation, and the interplay between financial markets and corporate decision making. His publications have appeared in leading journals in Economics, Finance, and Management including the Review of Economic Studies, Review of Financial Studies, and Management Science.

Searching for Information (with Jungsuk Han)

Journal of Economic Theory, 175, 342-373 (2018)

Suppose an investor seeks to gather information for investment in a firm's stock. Should the investor read analyst reports and find out about revenue projections? Or should the investor look at social medias to find out what other investors think about the stock? More generally, how do agents learn when relevant information has to be searched for? To answer these questions, we provide a search-based information acquisition framework using an urn model with an asymptotic approach.

Our framework is based on a simple intuition: the more an agent searches for new information about an unknown fundamental variable, the more likely he is to encounter information that overlaps--and that is therefore redundant--with information already discovered from past searching activities. Similarly, multiple agents who search from the same source of information will face increasing redundancy as more information is collected, therebyincreasing the commonality of collected information. This increasing redundancy slows down learning about the fundamental, but speeds up learning about what other agents have learned. This effect is more pronounced when the amount of information that can be squeezed out of the information source is more limited. When agents want to learn what others know, as in Keynes' beauty contest analogy of the stock market, they may choose to learn, and act upon, information from inferior information sources.

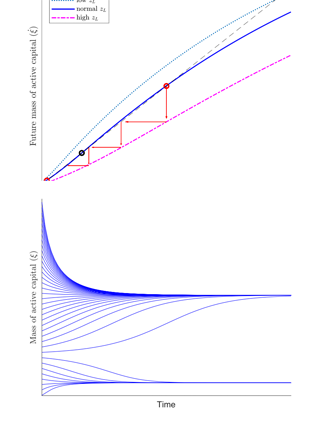

Bottom: Evolutionary paths

Hysteresis in price efficiency and the economics of slow moving capital (with James Dow and Jungsuk Han)

Review of Financial Studies, accepted for publication

Will arbitrage capital flow into markets experiencing shocks, mitigating adverse effects on price efficiency? Not necessarily. In a dynamic model with privately informed capital constrained arbitrageurs, we show how price efficiency plays a dual role, determining both the profitability of new arbitrage and the ability to close existing positions profitably.

In traditional models, when capital is available investors will engage in arbitrage activities forcing price equal to fundamental value and market efficiency is restored. Hence, once a bad shock to the economy is removed, the system should go back to normal. Conventional models, however, fall short in explaining the ubiquitous phenomena of slow-moving capital. Our paper explains that even though capital is available it does not necessarily translate into market efficiency. The amount of “active capital”, which we define as capital ready and willing to be deployed, may be more important than the amount of capital itself. When mispricing increases due to a bad shock, arbitrageurs’ existing positions take a longer time to realize profits. This makes active capital more scarce as those arbitrageurs have to wait longer with their positions. If so, arbitrageurs with available capital abstain from exploiting arbitrage opportunities knowing that the investment horizon will be lengthened. This leads to a negative cycle of further mispricing, which in turn reduces active capital even further. Because of this feedback loop, a shock can have a persistent effect on price efficiency, creating a strong path dependency, or hysteresis.

Factor Investing, Learning from Prices, and Endogenous Uncertainty in Asset Markets

(with Chukwuma Dim and Grigory Vilkov)

The factor-based paradigm has gained popularity over the last decades, both in the asset-management industry and in academic asset pricing research. Under this paradigm, should investors learn only about systematic risk? Or is the traditional stock valuation approach still valid? Does the focus on systematic factors improve price efficiency in financial markets? Does it affect the risk in managed portfolios?

To answer these questions, we consider an endogenous information model with many correlated assets. We find a novel source of learning complementarity: As investors shift attention toward a systematic risk factor and away from individual securities, these securities’ prices become less informative about the systematic factor. This raises systematic uncertainty, providing further incentives to learn about systematic risk. This learning complementarity leads to multiple regimes in systematic uncertainty and attention allocation. Empirically, we estimate a model-based, forward-looking proxy for investor attention to systematic information relative to firm-level information. As predicted by the model, this measure follows a regime-switching process. The high-level regime is linked to lower stock price sensitivity to firm-specific information and higher systematic risk in managed portfolios.